Achieving financial independence is a goal many aspire to but often misunderstand or overlook in the rush of daily life. It is more than just having enough money to pay the bills, it’s about reaching a point where you have the freedom to live life on your terms, without the constant worry of financial constraints. Wealth building, on the other hand, is the process of accumulating assets over time to create a secure and prosperous future. Both concepts go hand-in-hand, offering a path to a more fulfilling life, not just for yourself but also for those around you. Let’s explore why financial independence and wealth building are crucial and how they benefit you and your loved ones.

Understanding Financial Independence and Wealth Building

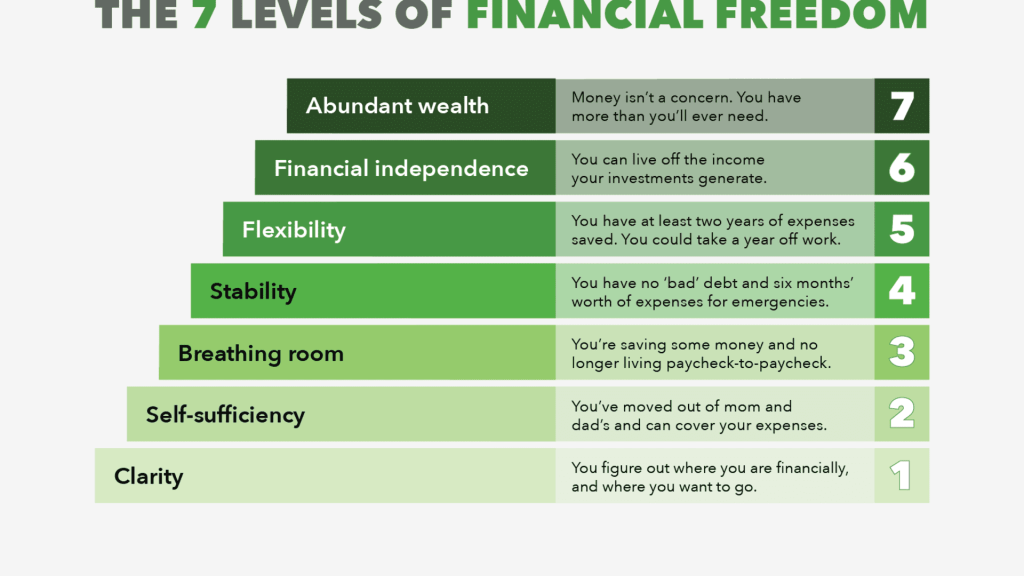

Financial Independence means having sufficient income to cover your living expenses without needing to work actively. This could come from investments, passive income streams, or savings that generate enough returns to support your lifestyle. It’s about freedom, the freedom to make choices that are not primarily influenced by financial considerations.,

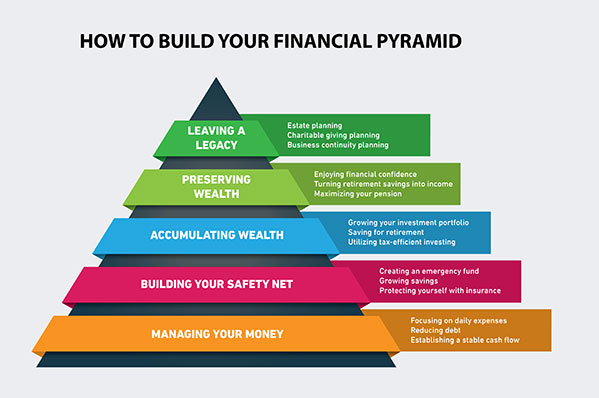

Wealth Building is the process of growing your financial resources over time. This involves smart investing, saving, minimizing debt, and creating multiple income streams. Wealth building is not just about accumulating money; it’s about creating a stable foundation that allows you to withstand financial uncertainties and pursue opportunities.

The Benefits of Financial Independence and Wealth Building

- Freedom to Choose Your Path

Financial independence grants you the ability to make decisions based on passion, purpose, and values rather than just a paycheck. You can choose to retire early, start a business, or travel the world. The point is, you get to decide what your life looks like without being constrained by financial needs. - Reduced Stress and Anxiety

One of the greatest benefits of financial independence is the reduction of stress and anxiety associated with money. Financial worries are a significant source of stress for many people. When you achieve financial independence, you eliminate a major source of worry, leading to improved mental and physical health. - Greater Focus on Personal Growth

With financial concerns minimized, you have more time and energy to focus on personal growth, learning, and development. You can invest in education, hobbies, or activities that enrich your life, leading to a more fulfilling and meaningful existence. - Enhanced Security and Stability

Building wealth provides a financial cushion that helps protect against unforeseen events, such as medical emergencies, job loss, or economic downturns. This security ensures that you and your loved ones are not vulnerable to life’s uncertainties. - Ability to Support and Empower Others

When you are financially secure, you can extend that security to others. You can help family members, support friends in need, or contribute to causes you believe in. Your financial independence becomes a source of support and empowerment for those around you. - Improved Relationships

Financial stress often negatively affects relationships. When you achieve financial independence, you remove a common source of tension. This can lead to more harmonious and supportive relationships, fostering better communication and mutual respect. - Opportunity to Leave a Legacy

Wealth building allows you to create a legacy for future generations. Whether it’s through financial inheritance, philanthropic efforts, or simply setting a strong financial example, you have the power to make a lasting impact.

Why Financial Independence and Wealth Building are Good for You and Those Around You

Achieving financial independence and building wealth aren’t just personal victories; they have a ripple effect on those around you. Here’s why:

- Promotes a Positive Financial Mindset

By focusing on financial independence and wealth building, you cultivate a mindset of abundance, responsibility, and growth. This mindset encourages healthy financial habits in those around you, especially younger generations who observe and learn from your example. - Inspires and Motivates Others

Your journey to financial independence can inspire others to take control of their finances and pursue their goals. You become a living testament to the possibilities of smart financial planning and disciplined wealth building. - Reduces Dependency

When you are financially independent, you are less likely to depend on others, whether it’s family, friends, or social systems. This reduction in dependency creates a healthier dynamic in relationships and fosters mutual respect and autonomy. - Creates a Positive Community Impact

Financially independent individuals are often more likely to contribute to their communities, whether through charitable donations, volunteering, or supporting local businesses. This contribution helps create a more robust, resilient, and prosperous community. - Improves Financial Literacy and Awareness

As you share your journey, strategies, and successes, you promote financial literacy among those around you. Increased awareness and understanding of money management help everyone make better financial decisions, ultimately leading to a more financially stable society.

Steps to Achieve Financial Independence and Build Wealth

- Set Clear Financial Goals

Define what financial independence looks like for you. Whether it’s paying off all debt, saving a specific amount for retirement, or building a diverse investment portfolio, having clear goals gives you direction and motivation. - Create a Budget and Stick to It

A well-planned budget is the foundation of financial independence. It helps you track income, expenses, and savings, ensuring that you live within your means and allocate funds toward your goals. - Invest Wisely

Invest in assets that grow over time, such as stocks, real estate, or businesses. Diversifying your investments reduces risk and maximizes returns, accelerating your path to financial independence. - Minimize Debt and Build an Emergency Fund

High-interest debt can significantly impede wealth-building efforts. Focus on paying down debt as quickly as possible while building an emergency fund to cover unexpected expenses. - Develop Multiple Income Streams

Relying on a single source of income is risky. Developing multiple income streams—whether through side hustles, investments, or passive income—provides greater financial security. - Continue Learning and Adapting

Financial independence is a journey, not a destination. Stay informed about financial trends, invest in self-education, and adapt your strategies as needed to stay on track.

Conclusion

Financial independence and wealth building are transformative goals that offer immense benefits to you and those around you. They provide freedom, security, and the ability to live a life of purpose and passion. By taking control of your financial future, you not only enhance your own well-being but also positively impact the lives of others. Start your journey today and enjoy the peace of mind that comes with financial freedom.

Leave a comment